You don’t have to be a conspiracy theorist to want the government to stay out of your finances. How and where you invest your own money, assuming you’ve paid relevant taxes and obtained the money legally, should be none of Uncle Sam’s business. That’s why American Gold (and Silver) Eagles represent the best deal for most investors.

But why? Why are American Eagles the best bet? Two reasons – inflation (monetray policy) and tax benefits.

INFLATION

First we’ll talk about inflation. The Federal Reserve policies of the last twenty years have had the effect of making a one-pound loaf of bread mysteriously weigh 12 ounces while the price has doubled. It’s turned 8oz yogurt cups into 6oz yogurt cups for 50% more cost…it’s made milk, gas, coffee and orange juice – virtually everything we use on a day to day basis increase in price because of the devaluation of the dollar.

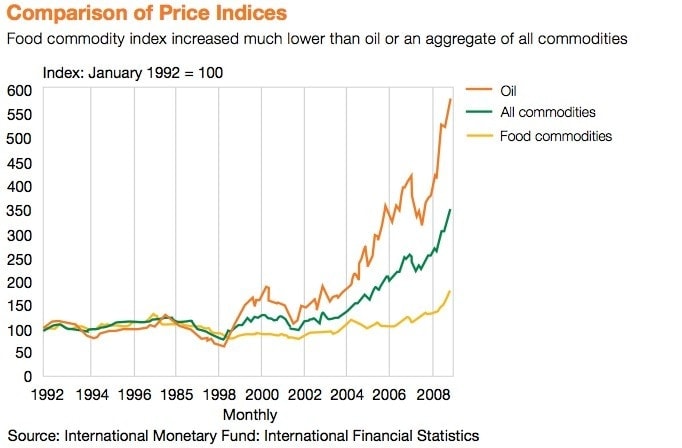

In all fairness, it hasn’t been just the result of Fed policies. Wall Street’s insatiable thirst for money (because 100s of billions is never enough) also has added fuel to the fire that’s been torching the value of the dollar. Goldman Sachs petitioned the Commodities Futures Trading Commission, the federal watch dog of all things traded and sold on the commodities exchange, to engage in substantially greater hedging than ever existed in previous history. Goldman Sachs essentially turned a reliable system of commodities hedging into a manipulated market. As you can see below, about the same time Goldman Sachs entered the game, commodities took off in price. For decades, prices were held in check by a system of buyers, sellers and the men in the middle, the hedgers. But Goldman changed all that. As the chart demonstrates, prices that for years had been relatively stable, went through the roof. Coincidence? Perhaps. Or collusion.

In any case, don’t be fooled by the Goldman Sachs commercials about loaning the University of Louisville money to build their new stadium. That’s not how Goldman makes money. That’s window dressing and PR. Goldman makes money manipulating markets. Like fuel, mortgages, commodities, etc.

But as we said, Goldman is only part of the problem of in a corrupt, fascist system that pairs corporate titans like Goldman with the United States government in order to enrich a few, privileged individuals. The Fed is also responsible for policies that ensure your cash is worth less as time passes. By buying it’s own debt, the US ensures that each dollar is worth less over time. So if it’s worth less as time passes, and nothing stops the passage of time, then it’s nearly worthless.

And that’s why American Eagles represent a great place to park money. If it’s in dollars, and dollars are losing value, gold represents a better, worthmore alternative. Not worthless, worthmore.

TAXES

But the final piece of the puzzle is that American Eagles also have a tax advantage over other non-American bullion. After purchase, when you return to the dealer to sell your Eagles back, regardless of whether you made a profit or lost money – there is no tax reporting associated with Eagles. With Krugerrands or Canadian Maple Leafs, when you sell back more than $10,000 worth, the dealer is required to make a report to the IRS. No matter what. The trigger is the $10,000 limit. Not so with American Gold (and also Silver) Eagles. There are no reporting requirement with Eagles. Sell ten or ten thousand. There is no report. And when you’re hedging against inflation or hedging against government intrusion into your private affairs, with Eagles it’s between you and your dealer. And that’s the best hedge of all.

[featured_products per_page=”12″ columns=”4″ orderby=”date” order=”desc”]