How to Invest in Gold and Silver in Houston, TX.

Here are some basic thoughts on the subject investing in gold and silver bullion:

First, if you want to buy precious metals in Houston (or anywhere else) you should know that precious metals are volatile commodities. You could lose most or all of any investment. Although this is true of most investments other than low-yield bonds, as they carry lower risk, it is particularly true of gold and silver and platinum.

Investments in precious metals almost always mean gold and silver. Although we buy and sell platinum, it’s very rare. So platinum is a very distant third. There are other precious metals besides these three, but if you plan to buy precious metals in Houston, you’ll probably just be buying gold or silver.

Gold and silver are different metals obviously and as investments, they perform different functions:

GOLD

Gold is a great investment for hedging against inflation. When we say “hedging”, we mean reducing the effects of inflation. We’re talking about monies that you’ve already made acquired which can be converted to gold to protect against inflation. We’re NOT talking about buying gold to watch it appreciate. That could happen, but it’s not the norm. Gold usually holds its value against the dollar. Because of the effects of inflation, dollars will lose value, but gold will HOLD value. When you sell it, you will get all your money back…theoretically.

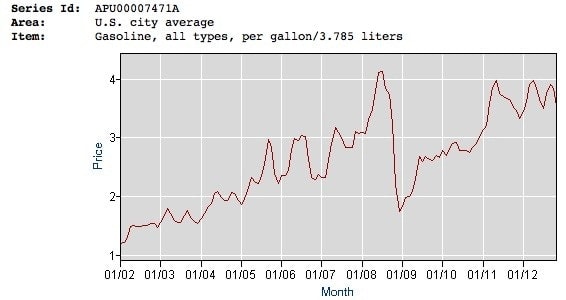

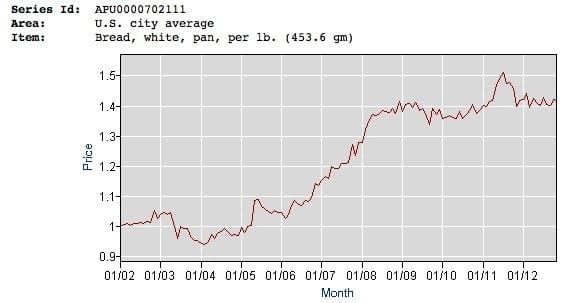

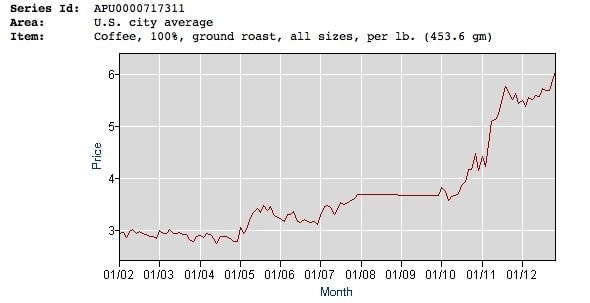

Below is a series of charts from the Bureau of Labor Statistics showing the increases in the prices of gas, bread and coffee over the last ten years. These losses in purchasing power are because of inflation. Gold and silver investments can protect you from these losses:

GASOLINE

BREAD

COFFEE

You can see that prices are going up for these and other products. When the effects of inflation are causing 100% increases ($3.00 to $6.00 on coffee), it makes good sense to “hedge” or reduce these effects by investing in precious metals.

While hedging is not a guarantee that your investments will not decrease in value, when used in conjunction with a diversified portfolio, it provides balance. No plan is foolproof, but diversification is a key to successful investing and “hedging” is a part of that strategy.

Gold is expensive. It’s as much as 50 times more expensive than silver and usually makes sense when you’re a high net worth individual.

Gold is easy to store. Because of its small physical footprint, gold is easily stored in a small space. This is one of the reasons that people love gold as an investment.

SILVER

Silver is also an excellent hedge. Good for maintaining wealth, but because it is less expensive, it’s more often purchased and is more widely available.

Silver is used in more industrial and commercial applications and is more likely to increase in value over the long term. (more upside)

Silver is more accessible to many more people and this provides flexibility when selling.

Silver is undervalued compared to its historical relationship to gold. For decades silver was 1/40th the price of gold. Today it is 1/50th the price. Most analysts believe that gold will continue to climb in price, but that silver will close that gap and return to its historic range.

So once you’ve decided which precious metal makes the most sense for you, (and there’s no reason you can’t do a little of both) you need to choose between bars and coins. Both are called bullion, each has its pros and cons.

COINS: Coins come in a variety of sizes and weights, but are generally uniform in mass. By that I mean, there is one size that every single 1oz American Eagle, South African Krugerrand or Canadian Maple Leaf comes in.

The American Gold Eagle is one ounce of gold and the coins are always 32.7mm across, weigh 33.93 grams and are 2.8mm thick. ALWAYS. If there’s a deviation from this size, then it’s a fake. So it’s very simple to invest in, even for beginners. If the coin size and weight don’t match these numbers, don’t buy it.

BARS: Bars on the other hand, do not have specific sizes and weights that you can depend on. Though some brands have conformity and standards, in general bars are not manufactured to the same standards as coins.

So now you have enough to get you started, but there’s still more to learn. Feel free to call me at 832 259 7225 and I’ll answer any questions you have about buying and selling gold or silver bullion in Houston.